tax identity theft def

How to protect your personal information and privacy stay safe online and help your kids do the same. Get Alerts Credit Reports and More.

Tax Identity Theft American Family Insurance

The IRS outlines its definition of tax identity theft as occurring when someone uses your stolen personal information including your Social Security number to file a tax return.

. During tax season tax identity theft is one of the most common forms of identity theft. This is the most common type of identity theft. Identity theft is the illegal use of someones personal information for individual gain.

Tax identity thieves steal. Ad Victim of Identity Theft. Definition of identity theft.

Tax-related identity theft occurs when someone uses your stolen Social Security Number to file a tax return claiming a fraudulent refund. File your return as early in the tax season as you can. The IRS protected a combined 26 billion in fraudulent refunds by stopping the.

Ad Victim of Identity Theft. Financial identity theft seeks economic benefits by using a stolen identity. Complete Edit or Print Tax Forms Instantly.

Personal tax ID theft happens when someone has stolen your personal information in order to. Published on April 30 2019. It turns out the COVID-19 pandemic has been a breeding ground for.

Ways of becoming a tax identity theft victim Personal tax identity theft. Thats the Greenlight effect. Tax identity theft whether its with the Internal Revenue Service or your state s Department of Revenue Franchise Tax Board or other Taxation agency can be a complicated issue to resolve.

Dont Wait to Get ID Theft Protection Start Today. How does tax identity theft happen. Synthetic fraud is a new form of identity theft in which a fraudster creates a false identity.

Tax identity theft occurs when someone uses your personal information including your Social Security number to file a bogus state or federal tax return in your name and collect. More from HR Block. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Identity theft is when a person steals your personal information to commit fraud. To obtain credit cards from banks and retailers. Criminal identity theft occurs when someone cited or arrested for a crime presents himself as another person by using that persons name and identifying information.

Tax-related identity theft occurs when someone uses your stolen Social Security Number to file a tax return claiming a fraudulent refund. Stealing your identity could mean using personal information without your permission such as. Take Action if You Are.

Meanwhile to help fight tax identity theft. You may not know youre a victim of identity theft until youre notified by the IRS of. Tax identity theft occurs when someone steals your Social Security Number SSN and uses it to file a fraudulent return in your name in order to steal your refund assuming that.

In this type of. Tax identity thieves steal. Identity theft occurs when someone uses another persons personal identifying information like their name identifying number or credit card number without their permission to commit.

In addition to promptly responding to IRS communications here are a few more steps you could take. Tax identity theft is when someone uses your personal information namely your Social Security number to file a tax return in your name. To steal money from existing.

Identity Theft and Online Security. The number of confirmed identity theft returns stopped by the IRS declined by 68 percent. Identity theft occurs when someone steals your identity to commit fraud.

Get Alerts Credit Reports and More. Identity Theft is the assumption of a persons identity in order for instance to obtain credit. Download the app today.

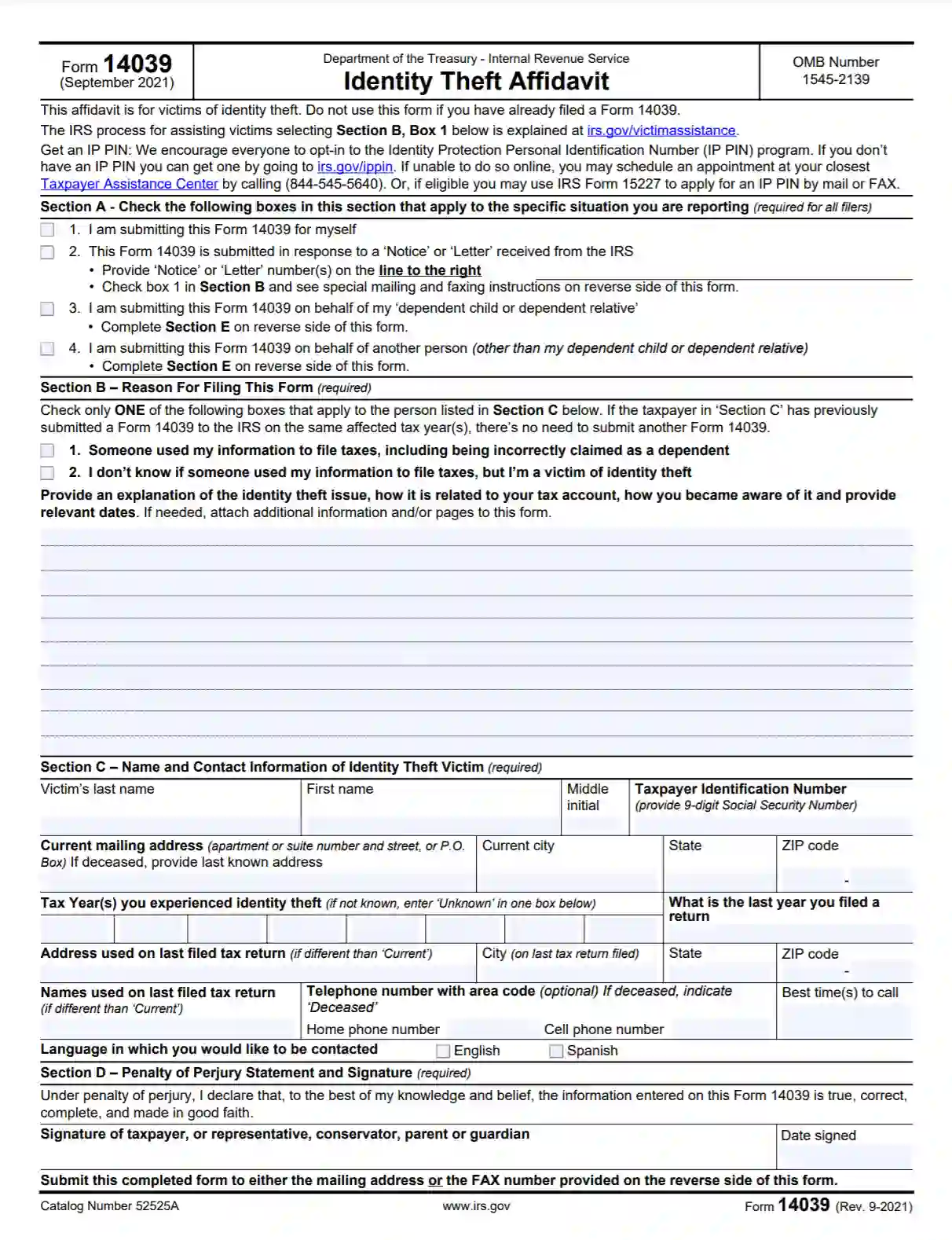

The Federal Trade Commission FTC reported a startling 113 increase in identity theft reports in 2020. Use a secure internet connection if. Youll use IRS Form 14039 to.

Tax identity theft is when a criminal steals your information specifically your Social. Ad Access IRS Tax Forms. Dont Wait to Get ID Theft Protection Start Today.

The illegal use of someone elses personal information such as a Social Security number especially in order to obtain money or credit. Register here so you can call in with questions. Complete an IRS Identity Theft Affidavit.

Taxpayer Guide to Identity Theft Know the Signs of Identity Theft. Tax identity theft is a growing issue and occurs when someone uses another individuals Social Security number SSN to file a false tax return claiming a fraudulent refund. Also known as identity fraud this type of theft can cost a victim.

Ad The money app for families. Learn what tax identity theft is. More from HR Block.

Types Of Identity Theft And Fraud Experian

Where Does Identity Theft Happen Most Bankrate

Understanding Business Identity Theft What Makes It Vulnerable

What Is Identity Theft Definition From Searchsecurity

Identity Theft Definition What Is Identity Theft Avg

7 Common Identity Theft Scams Bankrate

Identity Theft Definition Stats Protection Techpout

Tax Identity Theft American Family Insurance

Dark Web Monitoring What You Should Know Consumer Federation Of America

Learn About Identity Theft And What To Do If You Become A Victim

Irs Notice Cp01a The Irs Assigned You An Identity Protection Personal Identification Number Ip Pin H R Block

What Is Identity Theft Definition From Searchsecurity

Identity Theft Laws In California Penal Code 530 5 Pc

What Is Identity Theft Definition Types Protection Study Com

5 1 28 Identity Theft For Collection Employees Internal Revenue Service

/identity-theft-in-asia-56fe41915f9b586195f2a98d.jpg)